Broker vs Bank – Which is Right for You When Navigating a Personal Loan?

Choosing between a broker and a bank for a personal loan is a decision that hinges on personalised needs and preferences. In the “broker vs bank” debate, a broker can navigate through a range of lenders for you, while a bank may offer a more straightforward lending experience if you fit their criteria. This guide will help you understand the intricacies of both choices in the broker vs bank comparison, ensuring you make an informed decision that aligns with your financial journey.

Key Takeaways

- Finance brokers act as intermediaries offering a wide range of loan options by comparing multiple lenders, thus helping borrowers with diverse or complex financial needs to tailor their loan experience.

- Banks are direct lenders providing their own loan products, which can simplify and expedite the loan process for qualified individuals with strong credit and straightforward financial needs.

- When selecting between a broker and a bank, one must consider factors like personal credit score, loan complexity, and individual preferences, while also thoroughly researching and comparing loan options, rates and fees.

Understanding Finance Brokers and Banks

Embarking on the quest for a personal loan, you’re presented with a fork in the road: one path leads to a finance broker, the other to a bank. Both avenues can take you to your desired destination—a loan that fits your financial situation like a glove—but the journey will differ. Let’s set the scene: finance brokers are the scouts, the intermediaries who know the lay of the land, while banks are the storied cities, the direct lenders from whom the bounty flows.

Brokers serve as the bridge between you and the loan suited for your needs. They scour the landscape, comparing loans from multiple lenders, and present you with options that align with your financial goals.

Banks, on the other hand, are the direct source of funding, offering you their own loan products. Your choice hinges on your preferences and circumstances—do you seek a guide to lead you through the wilderness, or do you prefer to negotiate directly with the source?

Finance Brokers: The Middlemen

A good finance broker acts as a seasoned pathfinder, navigating you through the forest of loan options. They connect you with multiple lenders, from towering financial institutions to niche credit providers. With a broker, your loan becomes a tailored expedition, looking at broad range of loan products that might otherwise remain undiscovered. In the process of choosing a broker, you might wonder about the broker vs other options available in the market. Understanding how brokers work can help you make an informed decision.

Imagine having a personal advisor who gathers your financial information—your income, credit report, the works—and uses this to map out your best route. Brokers do just that; their expertise lies in finding loans that might elude the less experienced traveller. They can even navigate tricky terrains—for the less qualified buyer or those eyeing unconventional assets, a broker’s network is invaluable. And when the path ahead seems costly, they can employ strategies to lighten your upfront burden. But, as with any guide, it’s wise to verify their credentials and ensure they’re equipped for the journey ahead.

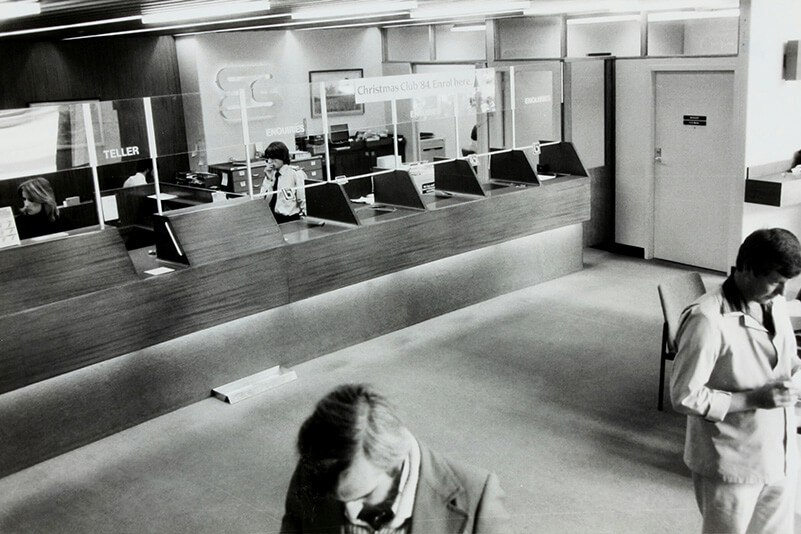

Banks: The Direct Lenders

Now, let us turn to the banks. As direct lenders, they are like the great rivers that flow straight from the source. With portfolio lenders ready to serve, they can offer swift passage through the loan approval process, ensuring a more straightforward trek for those with all their provisions in order—strong credit history, substantial income, and solid assets.

However, banks often follow their own maps, limited to their loan products and strict lending policies. This can be less than ideal for those whose journeys are more complex, possibly requiring a guide to find alternative routes. But for the seasoned travelers with clear destinations and the right credentials, a bank’s straightforward process can lead to a timely and potentially cost-effective loan.

Weighing the Pros and Cons: Broker vs Bank

As with any expedition, preparation is key. Before embarking on the path to a personal loan, it’s crucial to weigh the benefits and drawbacks of your potential companions: the broker and the bank. By comparing their virtues and vices, you’ll be better equipped to choose the ally that best aligns with your financial vision.

The Benefits of Finance Brokers

Trekking through the loans industry with a broker by your side can open paths to lenders you might never have encountered alone. A good finance broker taps into a network of lenders, which could mean securing more favorable personal loan interest rates. For those with complex financial landscapes—like the self-employed or those with a less-than-perfect credit history—a broker’s tailored approach can transform challenging terrain into navigable ground.

The services of brokers often come at no cost to you, the borrower, and are a beacon of guidance through the loan application process. They offer personalised service, a hand to hold for those who find the financial world daunting, ensuring that your loan fits not just your financial situation but your life’s blueprint. It’s a level of human interaction and understanding that can make the difference between a rocky path and a smooth journey.

The Drawbacks of Finance Brokers

However, even the most seasoned guides may have their pitfalls. The relationship between some finance brokers and lenders can be a little too cosy, with commissions potentially swaying a broker’s compass, leading you to a more expensive loan than necessary. And while brokers work to map out your loan options, some brokers initial estimates can shift, resulting in higher rates or unexpected fees when the final details are hammered out.

As a borrower, you must remain vigilant, comparing the broker’s offerings with other financial institutions to ensure you’re truly getting the best deal. Trust, but verify, to ensure your broker’s path aligns with your financial goals.

The Benefits of Banks

The direct route through a bank has its own set of advantages. As financial institutions with solid foundations, banks can offer the familiarity and speed that comes from an existing customer relationship. Processing times for loans can be fast, an advantage for those who need things to happen quickly.

When the journey is straightforward, and the applicant is well-prepared, a bank’s path can be both quick and cost-effective. With a strong credit history and clear financial position, the bank’s terrain may offer the most efficient and potentially least expensive route to securing a loan.

The Drawbacks of Banks

Yet, for all their strengths, banks are not without their limitations. Their loan options are confined to their own portfolios, adhering to lending policies that may not fit every borrower’s unique journey. This rigidity can be a barrier, especially for those with a more complex financial history.

Additionally, navigating multiple banks directly can be a time-consuming quest, and each credit inquiry along the way could leave footprints on your credit score, potentially affecting future applications. So while a bank may offer a direct path, it’s not always the most accommodating.

Factors to Consider When Choosing Between Broker and Bank

As the landscape of personal loans unfolds before you, there are several signposts to guide your decision between the assistance of a broker and the direct lending of a bank. Your credit score, the complexity of your desired loan, and your personal preferences are the stars by which you’ll navigate this choice.

Your Credit Score

Your credit score is the beacon that signals to lenders your financial trustworthiness. Banks often set their course by the strength of these signals, favouring clients whose credit history has less flaws. On the flip side, brokers can be a lighthouse for those navigating through foggy credit waters, guiding borrowers with lower credit scores to lenders with more flexible lending criteria.

While specialised lenders, often part of a broker’s network, may offer more lenient terms, banks’ stringent credit requirements could leave those with less-than-stellar credit adrift. For those with high credit scores, the banks’ loan options may prove best, offering favorable interest rates and terms that reward a strong financial position.

Loan Complexity

The complexity of your loan needs can also dictate whether a broker or a bank is your best ally. Brokers excel in charting courses through complex financial situations, providing access to a wide array of loan products. They are the seasoned navigators for tricky financial voyages—be it an investment property, a unique asset or a consolidation loan.

Conversely, banks may offer a more streamlined voyage for those with straightforward loan requirements. Yet, for the borrower whose financial landscape is not typical, a broker’s expertise in the loan process can mean a more tailored, route to the right loan.

Personal Preferences

At the end of the day, the choice between a broker vs bank often boils down to personal comfort and trust. Some borrowers may prefer the personalised guidance and support a broker provides, especially through the journey of a loan or mortgage application process. Others might find solace in their local bank, where existing relationships and face-to-face interactions offer a sense of security.

Ultimately, the decision is a deeply personal one, influenced by individual circumstances and the level of autonomy one desires in the journey to secure a loan. Whether you choose the broad range of options offered by a broker or the streamlined process of a bank, ensure it’s a path that resonates with your personal financial ethos.

Tips for Finding the Right Finance Broker or Bank

With the trails of brokers and banks laid out before you, how do you choose the right guide for your journey? Here are some seasoned tips to help you find the financial ally that will best serve your quest for the perfect loan.

Research and Referrals

The first step is to gather wisdom from those who have been there before. Here are some steps to follow:

- Ask friends, family and colleagues for referrals to reputable brokers.

- Read online reviews to learn about the experiences of past borrowers.

- Don’t go with the first broker you meet, if it doesn’t feel right. Meet with a couple of brokers to assess their experience and approach, ensuring an alignment.

The right broker should not only guide you to successful loan options but also through the application process itself.

Comparing Loan Options

As with any journey, it’s wise to explore multiple paths. Shop around with various lending institutions—brokers and banks alike—to see who offers the best deal based on your situation. This includes considering your credit score, down payment, and desired loan amount.

Comparing quotes from at least three different lenders is like surveying the landscape from a high vantage point—it gives you perspective. Ensure you’re getting a competitive offer by not only comparing rates but also loan terms and fees. Remember, a lower interest rate might be enticing, but the right loan is about the best overall deal. So, take the time to compare loans to make an informed decision.

Evaluating Fees and Charges

Lastly, be mindful of the tolls along the way. Submitting applications to multiple lenders directly can be like taking a step forward and two steps back, as it may impact your credit score and lead to unnecessary charges. Instead, gauge the complete cost of your loan options by comparing rates, including all fees and charges, to ensure you don’t end up paying more than you bargained for in the long run.

Evaluating the financial landscape with a keen eye on fees, including the loan origination fee, will help you avoid any hidden pitfalls. Remember, the cheapest loan at first glance may not always be the most economical choice over time. Look for transparency and clarity from your chosen financial partner, be it a broker or a bank.

It’s clear that the choice between a broker and a bank is not a matter of which path is better but which path is better for you. A broker can offer a tailored journey with a diverse range of options, while a bank provides the direct route, often faster and sometimes more cost-effective for those with a clear financial trail.

Remember, the best decision is an informed one. Consider your financial position, the complexity of your loan needs, and your personal preferences. Whether you choose the guidance of a broker or the straightforward process of a bank, ensure that your chosen path leads to a loan that supports your financial goals and dreams. Now, armed with knowledge and insight, you’re ready to embark on the path to the right loan.

FAQs

It may be challenging to get a good loan from a bank with a poor credit score due to their stringent credit requirements. However, specialised lenders, often accessible through brokers, may offer more flexible lending criteria in these situations.